child tax credit november 2021 not received

Child Tax Credit on 2021 Taxes. 622 AM CST November 14 2021 The November advance child tax credit payment comes Monday to millions of Americans.

The Child Tax Credit Toolkit The White House

While the October payments of the Child Tax Program have been sent out many parents have said they did not.

. Child Tax Credit - 2021 born baby. With families set to receive 300 for each child under 6 and 250 for each child between 6 and. 947 ET Oct 21 2021.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. The IRS estimates it will pay out 15 billion in this installment alone.

That means the October November and December payments for affected parents will be reduced by 10-to-13 per child. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. Due to a change to the Child Tax Credit families can get half of the fully refundable creditworth up to 3600 per childas advance monthly payments in 2021 and the other half as a refund in 2022.

No Tax Knowledge Needed. Low-income families who are not getting payments and have not filed a tax return can still get one. The monthly child tax credit payments which began in July are set to end in December.

Many low-income families eligible for the monthly child tax credit payments had not signed up to receive them. The enhanced child tax credit which was created as part of the 19. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet To reconcile advance payments on your 2021 return. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Families who are eligible but havent signed up could receive the amount of all the advance payments as one lump sum if they opt-in for the final payment of 2021 before the deadline date.

Advance Child Tax Credit Payments in 2021. As November child tax credits are delivered parents have one last chance to sign up for advance payment Published Mon Nov 15 2021 116 PM EST Alicia Adamczyk AliciaAdamczyk. If you did not receive advance payments of the child tax credit in 2021 you can receive the full 3600 credit if you qualify when you file your tax return.

Those who have already signed up will receive their payments after they are. IR-2021-222 November 12 2021. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. Katie Teague Peter Butler March 23 2022 315 pm. Target Coupons Promo Codes For November 2016 Up To 175 Off Target Coupons Target Coupons Codes Coupons.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return.

Thats because the Child Tax Credit is for 2021 which means that a 5-year-old who. The only way to claim your full Child Tax Credit is by filing a 2021 Return. TurboTax Makes It Easy To Get Your Taxes Done Right.

If you did not receive advance payments and you were not required to file you must sign up by November 15 2021 to receive payment in 2021. The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Can the parent of any baby born in 2021 claim the child tax credit. The 2021 advance monthly child tax credit payments started automatically in July. Parents of any baby born in the US.

During 2021 can claim the child tax credit. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

15 deadline according to the IRS will normally receive half of their total child tax credit on Dec. 1201 ET Oct 20 2021. Start 2021 Child Tax Credit Calculator.

Wednesday March 23 2022. But theres a catch. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

Child tax credit november 2021 not received. The child needs to younger than 6 as of December 31 2021 to receive the full 300 credit.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

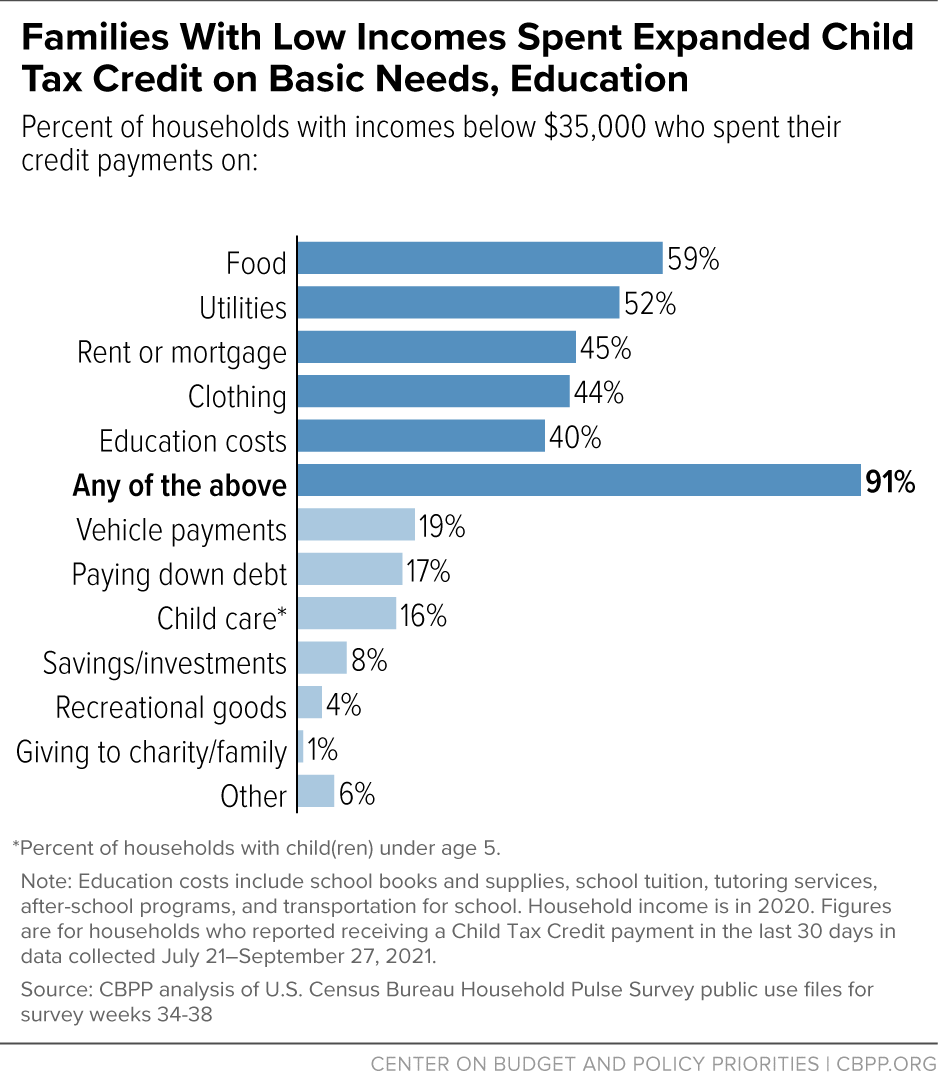

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Schedule 8812 H R Block

Did Your Advance Child Tax Credit Payment End Or Change Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Child Tax Credit Toolkit The White House

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week